Argentina: Brief evolution of the insurance market in Argentina in the past 30 years

Although the insurance market in Argentina has existed since the 18th century and the Superintendency of Insurance (SSN), the Government entity that controls the activity, was created in 1937, the development of the industry was not a steady one, due to the ups and downs of the Argentine economy.

Since the middle of the 20th century Argentina has suffered from chronicle inflation, which undermined the life insurance share of the marketplace.

It is also curious that when the annual industry premiums are expressed in hard currency, there is a marked volatility depending on the Government exchange policy of the moment.

A final consideration has to be made regarding which coverages have the most market share. Those are basically workers’ compensation and car insurance, and the reason is that they are mandatory by law. The following is a description of the most important figures that describe the evolution of the insurance industry for the past 30 years.

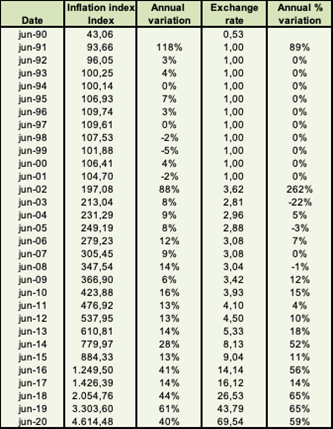

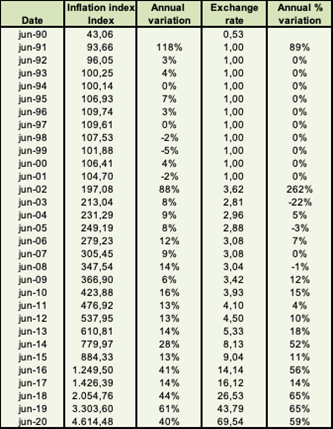

Inflation and exchange rate

The Argentine economy is very peculiar. It is interesting to see the evolution of the inflation rate and the exchange rate, that is, the relationship between the local currency and the US dollar.

Sources: Indec (Institute of Statistics and Census) with certain adjustments

Inflation index refers to IPIM (Wholesale Prices Index)

It is interesting to note that in the whole 30 years period, inflation, measured by wholesale prices, increased 107 times, while the peso lost its value against the US dollar 131 times.

Then, came a period of 10 years’ stability (1991-2001), with no inflation and no devaluation. In the past 20 years, inflation increased 43 times and devaluation, 70 times. Finally, in the past 10 years, the inflation rate was 989%, while the devaluation rate was 1.669%. This introduction will allow us to better understand the insurance industry evolution over the past 30 years.

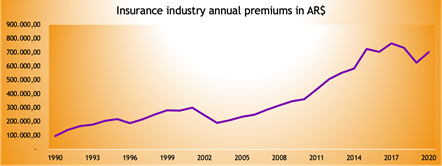

Annual premiums total market and other measures

The insurance market files annual statements every June. Therefore, statistics are generally built on that basis.

By June 2020, the insurance industry total production was around AR$ 700 billion, equivalent to around US$ 10 billion.

The evolution, in constant AR$ as of June 2020 (this is, nominal AR currency adjusted by wholesale prices as of June 2020), is the following:

Source: Superintendency of Insurance (SSN) with some adjustments

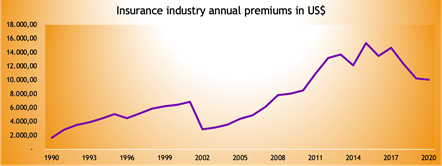

Combining the last chart with the first, we could see the evolution of annual premiums of the total insurance industry in US$ dollars.

Based on SSN data and own calculations

If we compare the annual production in local currency with the one expressed in US dollar terms, we could see that they do not have exactly the same shape, due to fluctuations in the exchange rate. The following graphs show this visually:

The ups and downs of the Argentine economy can be visualized in those tables. Argentina experienced economic stability in the 90´s. Therefore, this is represented by a steady growth of total revenues of the insurance industry in the period 1990-2001. In 2002 there was a huge political, economic and social crisis which led to a devaluation of 262% and wholesale prices inflation of 88% in one year. This explains an abrupt descent of the insurance market production followed by a low but steady recovery, due to the price increase in commodities based on the economic boom because of China’s emergence as a big buyer (Argentina is a big soybean exporter).

However, due to the end of that prosperity cycle and to some internal political issues, we experienced decline in the past 3/5 years.

Today, annual premiums per capita are around US$ 222, almost 50% less that its peak in 2013.

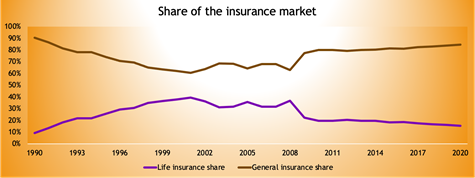

Market share of general and life insurance

Today life insurance (including life, annuities, health, personal accident and burial insurance) represents 15% of total annual revenues, showing a constant decline from its peak of 39.5%, in 2001. There are specific reasons for this, as in the 90´s there was a statutory defined contribution Social Security System, where pensions were paid from annuities purchased in insurance companies. The pay as you go Social Security system replaced the Defined Contribution Social Security in 2008 and, with the return of inflation, led to a downfall of the share of life insurance.

The following chart illustrates the evolution of both general and life insurance in the last 30 years.

Share of different lines of insurance

As we saw, general insurance represents 85% of total annual premiums. Main lines are:

Line | Share (2020) |

| Car Workers compensation Fire Home and Commerce Agriculture Other | 43,5 29,9 5,8 5,8 2,7 12,4 |

As we can see, both car and workers’ compensation represent 73% of total general insurance annual premiums, given the fact that both coverages are mandatory.

And in life insurance, lines are:

Line | Share (2020) |

| Life Personal Accident Pensions Burial Health | 43,5 29,9 5,8 5,8 2,7 |

We can see that, except for pensions (which are remnants of the time that a Defined Contribution Social Security System existed), the other coverages are all made on an annual basis. In a context of inflation, coverages including savings, especially those with mathematical reserves, are not too much appreciated.

Conclusions

The above tables and graphics intended to show that the Argentine insurance industry evolved positively in the last 30 years but the volatility in its economy shows that the growth has not been steady. As the main lines of business are those that are mandated, this shows that the mentality of consumers is not matured yet as in more economically stable countries. Therefore, there is room to grow in the future.

We can reach the same conclusion if we see the Production/GDP ratio. Argentina´s ratio is more or less 3%, while the world average is around 7% (according to Swiss Re statistics).

Regarding life insurance, we could see the decline of its share in respect to the total industry in the past, coincidentally with the return of inflationary tendencies. Today life insurance annual premiums represent 0.4% of GDP, while the world average is 3%, according to Swiss Re statistics. If inflationary trends change in the future, surely life insurance lines will grow again, as happened in the past.

Fastman y Asociados